RETAILERS ARE INCREASING AD SPEND

Marketers and consumers are anticipating a strong 2021. As we saw during Black Friday of last year, many consumers chose to stay at home and shop online, bringing in-store sales down 52% year-over-year. According to Adobe Analytics, online shopping sales for Black Friday totaled a record of $9 billion, an increase of 21.6%, while Cyber Monday saw an even greater increase in online shopping at $10.8 billion. Once vaccines become widespread, Brick-and-Mortar stores are hoping for in-store traffic to return. One way to maintain brand awareness as the economy opens up and vaccinations become widespread for retailers is advertising. In 2021, 65% of CMO’s are planning on increasing their ad spend, while 24% expect no change and 10% plan on spending less. The National Retail Foundation forecast 2021 retail sales to grow between 6.5% and 8.2%, which would be the highest year-over-year growth in 17 years. Out-of-Home advertising is also expected to rebound in 2021. To keep shoppers safe in stores, retailers have been placing hand sanitizer kiosks, which 99% of shoppers said they feel safer at stores who are providing these stations. (Forbes: 3/5/21)

LINEAR, STREAMING, & FLUIDITY

Due to the tightness in the network TV marketplace, advertiser budgets “don’t carry the same weight they once did if an advertiser is unwilling to allow that money to be moved to the networks’ streaming and digital inventory.” However, networks are putting a premium on their inventory; “disincentivizing some advertisers from making the moves to be more flexible with where their ads appear.” In some cases, streaming CPM’s are 2x to 3x the cost of typical cable prices. Another challenge facing an advertiser’s decision between placing a portion of their linear buys within streaming placements (referred to as “fluidity deals”) is whether they’re getting a unit of comparable value, and where they’re going to run. (Digiday: 3/8/21)

AVOD GROWTH

Over the next four years advertising video on demand (AVOD) platforms are expected to grow to $18 billion by 2025, according to MoffettNathanson Research. In 2020, AVOD platforms were estimated at $4.4 billion, with Hulu grabbing the bulk at $2.5 billion. In 2025, the analysis projects that Hulu will continue to lead ($5.3 billion), followed by Roku ($4.4 billion), Peacock and Pluto ($2.3 billion for each), Tubi ($1.9 billion) and HBO Max ($500 million; advertising to come.) In the fourth quarter of 2020 Hulu brought in $653 million in advertising revenue, while Pluto and Roku channel pulled in $173 million and Tubi hit $105 million. (MediaPost: 3/8/21)

TV BY THE NUMBERS

NextTV’s weekly look at the top 25 most watch shows for the last week of February includes programming across all dayparts/genres. There’s representation from Sports (e.g. NCAA basketball, NBA, PGA, Sports Center), Morning News (GMA, Today Show, CBS This Morning, Fox & Friends), Evening News (NBC Nightly News with Lester Holt, ABC World News Tonight with David Muir) as well as syndication and classics (e.g. Friends, The Golden Girls, The Price is Right, Family Feud, Two and a Half Men, NCIS, and Law & Order.) (NextTV: 3/4/21)

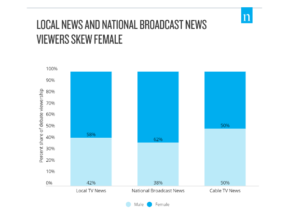

Timed with International Women’s Day, new research released by Nielsen illustrates the gender disparity in representation of women in media and business, which “only grows when you view the gender gap through a multicultural lens. Their goal of helping the media industry power diverse content creation, not only “matters ethically, but also because it matters to the viewers who are ultimately your consumers.” Importantly, female-led households increased 41% in the last 5 years, while women are responsible for nearly $32 trillion in worldwide consumer spending. One way to reach these high value consumers is through local news and broadcast news which tends to skew female than cable tv news. Also of note, local news viewership increased 48% among women during the initial months of the pandemic (Nielsen: 3/8/21).