HOLIDAY SHOPPING BACK TO IN-PERSON

According to the NPD Group, fewer consumers plan to do their holiday shopping online this year (80%) compared to last year (85%), “which is the largest ever shift favoring stores.” Although the majority of people will still shop online, “fewer than three-quarters of consumers expect to shop online-only sites during the holidays, down from 79% last year.” Of those who plan to online shop 16% also plan to use an in-store or curbside pickup. Mass merchants are also expected to gain a lot of traffic because of more cost-conscious consumers this year. (NPD: 11/9/22)

UNIFIED TV CAMPAIGN VIEWS

Having a unified view of linear TV, CTV, and digital video would allow marketers to have “improved ad relevance and deeper engagement by improving cross-platform personalization and creative performance” according to Innovid. “Data ownership, inconsistent measurement, walled gardens, and siloed teams” are all standing in the way of more advertisers getting a unified view. In Innovid’s survey of advertisers, 66% of respondents felt that they need “consolidated tech” to streamline and automate ad measurement since “the metrics that matter to advertisers when looking at converged TV are online outcomes, unique reach, frequency and offline outcomes.” (NextTV: 11/14/22)

NIELSEN MRC SUSPENSION CONTINUED

According to the Media Rating Council, “measurement is still broken at Nielsen”, over a year after the firm admitted to “lowballing” national and local audiences, early in the pandemic. Nielsen was set to meet the audit committee on November 14th but has since been rescheduled. The MRC states that they “believe Nielsen has made significant progress on most of the issues that led to that suspension and MRC continues to actively work with Nielsen on a path to address the remaining issues.” Although the suspension is continued, there is hope that they will be reinstated to the National TV service “relatively soon.” (AdWeek: 11/15/22)

AVOD ENGAGEMENT

According to Parks Associates research, 23% of users with ad-supported OTT services click on ads that they watch or even buy what is being advertised. With 37 million US Internet households using at least one advertising-based OTT streaming service, “advertisers can reach many people, and consumers can get a lot of free content.” In the current economic climate, ad-based services are benefitting because consumers are rethinking their spending and switching to subscription-based streaming services to save costs. (Advanced Television: 11/15/22)

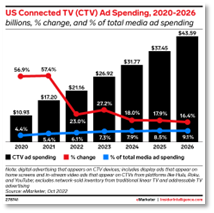

eMarketer issued their latest US Connected TV Advertising Forecast (requires subscription), which “includes trends, data and strategies related to how marketers are approaching CTV” as well as the latest CTV ad spending and viewing information. This year US advertisers will spend over $21 billion on CTV, up 23% from 2021. Two reasons that they raised their forecast: “more streaming services added advertising, and mid-tier streaming services experienced more ad growth than” previously expected. And while Linear TV accounts for more ad dollars than CTV, “the latter is rapidly catching up”; with ad spending expected to be 50% the size of linear TV ad spending by the end of 2024. (InsiderIntelligence: 11/10/21)