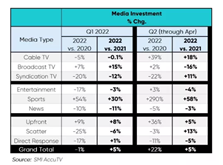

Standard Media Index (SMI) reports that April spending for national linear TV increased 5% vs. a year ago; following a flat month in March. Among the top five media companies, Warner Bros. Discovery, boosted by the NCAA tournament, received the largest revenue share; up 40% to 28%. And while Fox saw a slight gain (up 3%), the balance, Comcast (-2%), Paramount (-17%), and Disney (-7%), saw declines. SMI also looked at spending by category (entertainment, sports, news) and by type (upfront, scatter, DR) for April and Q1. (NextTV: 5/31/22)

Research firm, MoffettNathanson forecasts that “Local TV stations could see a 9% increase in ad revenues”, ending the year at 23.4 billion, and Local cable up 9% (to $5.3 billion). Conversely, national broadcast and cable are projected to decline slightly; with the four largest broadcast networks sinking 2% (to $14.7 billion) and national cable networks down 0.5% (to $28.8 billion). The report’s authors see “a mixed few quarters for linear TV as the tailwinds of sports gambling and political rub horns against macro and continued supply chain-related headwinds,” following an Olympics and political-fueled 1st quarter; up 8%. (MediaPost: 5/26/22)

CTV VIEWERSHIP

Sixty-four percent of CTV viewers prefer watching ads to paying more. That’s according to a new report by healthcare ad tech company, DeepIntent, which surveyed 2,900 CTV viewers on their viewing habits. They also compared survey results to the Automated Content Recognition (ACR) on their LG smart televisions and found that they’re streaming content more than they realize. And while 96% of linear viewers believe that they’re watching their favorite shows through their cable or satellite box, data from their TV sets indicate that only 48% are in fact watching cable/satellite. Conducted in late March, the additional findings include 65% of respondents saying that “targeted ads improve their experience” and 57% reporting that CTV ads are more relevant than linear TV. (Advanced Television: 6/1/22)

AVOD ADVERTISERS

According to MediaRadar’s analysis of 1Q22 spending, the top five OTT advertisers (Berkshire Hathaway, Capital One, Microsoft, State Farm, and Verizon) are responsible for 13% or $49 million, of overall spending ($369 million). MediaRadar’s CEO describes the impact that D2C companies have on the space, as well as the categories that drive a disproportionate amount of OTT spending (finance/insurance, media & entertainment, technology, automotive, restaurants, and pharma.) Looking ahead, Media Radar forecasts next quarter and the balance of the year, “based on the models we’re running right now.” (TVNewscheck: 5/27/22)

PRIDE MONTH ON TV

In honor of Pride Month, Variety published a guide to the live streams, pride parades in New York and Los Angeles, and other content airing on TV this month. Hulu airs content on their “Pride Never Stops,” Discovery+ has the “Always Proud” hub, and there’s “Paramount+ Celebrates Pride,” to name a few. Check here for the comprehensive list of content. (Variety.com: 5/26/22)