RECORD SPENDING FOR MOTHER’S DAY

A National Retail Federation report found that 84% of US adults expect to celebrate Mother’s Day this year, with plans to spend $35.7 billion; fully $4.0 billion higher than last year’s record of $31.7 billion. “According to the survey, consumers plan to spend $274.02 per person, the highest in the history of the survey and up from the previous record high of $245.76 in 2022.” Demographically, 35-44 years old are expected to be the top spenders at $382.26 on Mother’s Day. The most popular purchases are no surprises .. flowers, greeting cards, and special outings, with the highest spending behind jewelry, special outings, and electronics. Along with apparel, these categories will be the “primary drivers of growth this year.” (Yahoo: 4/27/23)

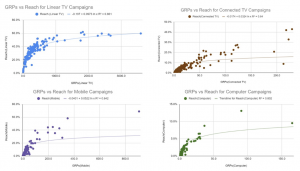

A Nielsen One study on cross-platform reach looked at 2,224 random campaigns during the 2022 broadcast year. It suggests that a mix that prioritizes linear, followed by mobile, CTV and computer, should be considered as plans are set for this year’s upfront. While the report indicates outliers, looking at normative reach vs. GRPs, “the linear curve tops out at about 60%”, while mobile is closer to 30%, CTV’s is 16%, and computer doesn’t quite reach 10%. To prepare for the Upfront, Media Village recommends studying the outliers, rolling up results across clients, and collaborating with clients “because the brands themselves have the fullest access to campaigns that have already run.” (MediaVillage: 4/27/23)

ADVERTISING POLITICAL CAUSES

According to Basis Technologies, “Advertisers are willing to spend more per vote than in the past, establishing a precedent that will likely ripple into 2024 and push the U.S. into a stunning new norm: the $10 billion election.” Increased spending behind political causes (not just candidates) will make this happen, with TV and CTV showing results. Conversely, social’s share of political ad spending has been on the decline since 2018, due to “decreasing trust in social media among policy influencers.” (SalesFuel: 4/2023)

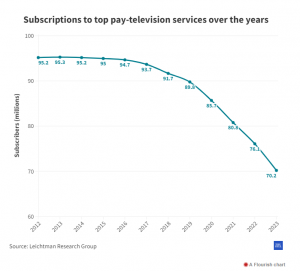

“Last summer, for the first time, streaming services like Netflix and Amazon Prime claimed the largest share of the television viewing audience surpassing both cable and broadcast TV.” According to Nielsen data, streaming captured 34.8% of July viewers, 34.4% for cable, and 21.6% for broadcast. In the second half of 2022, cord-cutters became the majority as the share of cable and satellite dipped. Two forces driving the rise of streaming over the past decade included faster internet download speeds and decreases in satisfaction with cable. However, a lot of those cord-cutters are actually people who “dropped cable while retaining internet and telephone service from the same company.” (The Hill: 4/26/23)