UPFRONT

Nielsen and Comscore are “unlikely to win accreditation of their national TV ratings services in time for the upfront.” The Media Ratings Council (MRC), the industry group established to certify measurement processes, posted a notice that audits of Nielsen’s “remediation work” (following last year’s undercounts) and Comscore’s TV-audience measurement service aren’t expected until third quarter 2022. While lack of accreditation doesn’t mean that ratings can’t be used, it’s spurred vendors and agencies to explore other measurement relationships. (Variety: 3/24/22)

OTT PERFORMANCE

A study released this week by Pathmatics, analyzed the “top performance trends for OTT from Q4 2021 into 2022” including ad spending. It found that “average OTT user streams more than two hours of content daily across an average of three devices via three different OTT services.” Additionally, ad spending reached $4 billion or “13% of the $32 billion in total ad spending.” The report looked at unit lengths as well as top categories (Financial Services followed by Health & Wellness) and top spenders. (Mediapost: 3/30/22

MEASUREMENT & SMART TV’S

Analysts agree that “large data sets from web-connected Smart TVs will play a critical role” as the industry focuses on next-generation audience measurement. With over half of all households in the country owning a Smart TV that’s capable of passive measurement, some manufacturers already have licensing agreements with third parties for their automated content recognition (ACR) data. Leadership from LG, Samsung, and Vizio, which account for over half of all sets sold, were invited to describe the role their organizations are playing in the “ever-evolving video landscape.” (Forbes: 3/28/22)

MOVIES ON TV

The pandemic has brought about an increase in home-based new movie viewing. A survey from the Motion Picture Association (MPA) conducted in January among over 8,000 adults, found that “people are now more likely to be watching movies at home via online subscription services than pay-TV. The report looked at increments of viewing from 2-3 times per month, once a week, several times a week, and every day. Online subscription viewing (82%) edged out pay-TV (79%), followed by physical discs (56%), and electronic sell-through (EST)/Video on Demand (VOD) at 52%. (Marketing Charts: 3/29/22)

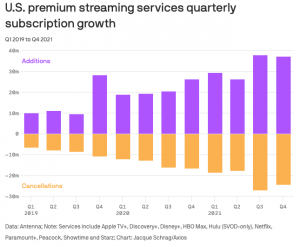

DOSE OF DATA

TV Rev’s Data Dose Newsletter is a “compilation of the key stats, data, and results driving the decisions and strategies for the future of TV.” Distributed every Wednesday, this week’s installment includes graphics on NBC’s share of ad impressions (16.44% thanks to the Super Bowl and the Olympics) from iSpot.TV, links to social video interest from Tubular Labs, fashion brand earned media value from CreatorIQ, a comparison of quarterly streaming “additions” and “cancellations” from Axios, and a look at increased privacy tech usage from Cheetah Digital. (TVRev: 3/24/22)