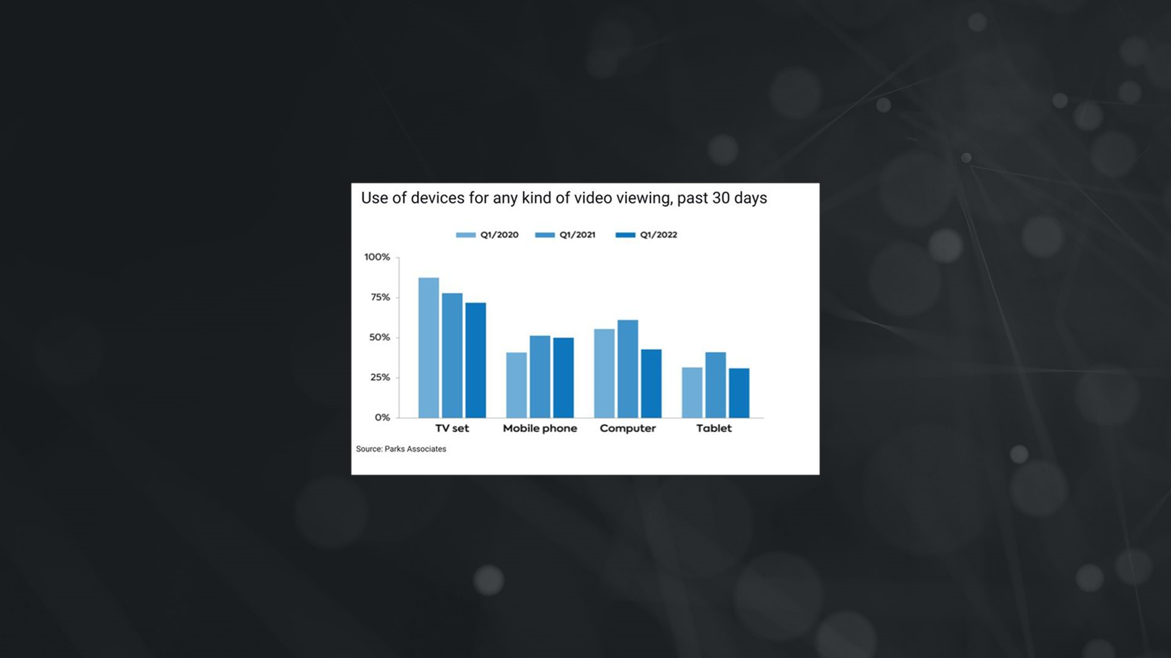

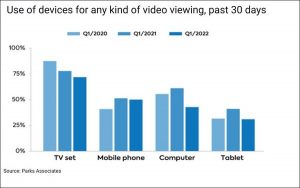

According to data from Parks Associates, TV Sets continue to be the most watched device for video viewing, although the percentages are on the decline. “As of this year’s first quarter, nearly half of consumers reported watching video on mobile phones within the past 30 days”, a figure that’s relatively flat vs. the previous year. Among those watching video on mobile, AVOD “accounts for the largest share of time spent … nearly two hours”, while SVOD and live streaming account for about an hour per week. Parks Associates CMO says that “the shift between platforms will push the industry to tailor services and content more aggressively to suit mobile phone viewers.” (MediaPost: 12/1/22)

CORD-CUTTING

MoffettNathanson’s Cord-Cutting Monitor reveals a 6.3% decline for pay TV distribution in Q3 2022. Pay TV is defined by MoffetNathenson to include “both traditional cable and satellite operators as well as newer vMVPDs like Fubo TV and YouTube TV.” Recent declines in “pay TV subscriptions have been coupled with higher levels of homes using TV antennas” (15% of the population according to Nielsen). While this trend may reaffirm the value of over-the-air broadcasts, stations that rely heavily on “retransmission consent payments from pay TV providers” may face financial challenges. (TVTechnology: 12/2/22)

STREAMING SUBSCRIBER SENTIMENT

Cost is a critical factor for subscribers when choosing to continue their subscriptions. “The rise in popularity of video streaming services has come amid […] cord-cutting, which has long been attributed to costs that subscribers did not want to bear for channels they didn’t watch.” A recent study from Ipsos investigated user attitudes of people who “subscribe to a paid/subscription-based streaming service with a library of shows and movies (e.g. Netflix) and/or a live TV streaming service (e.g. YouTube TV).” The findings “show that cost is the most important factor in decisions to drop or cancel a streaming service”, with 91% of respondents saying that the monthly or annual cost is an important factor, followed by 83% feeling that content changing is also an important factor. Other findings: 38% of subscribers are paying more for their streaming subscriptions this year vs. last, 8 in 10 subscribers agree that streaming services do a good job of showing characters from diverse backgrounds, and 68% prefer streaming services over traditional cable. However, just as many (69%) believe there are too many streaming services. (Marketing Charts: 12/1/22)

LOCAL BROADCAST AND THE COMMUNITY

Throughout this year’s hurricane season that affected the southeast, local broadcasters played an important role. “In the cases of (hurricanes) Ian and Nicole, it was the local radio and television broadcasters in Florida, Georgia, South Carolina, and North Carolina who were there for their communities as the storms unleashed their fury.” Since only the local broadcasters and local meteorologists were able to talk to specific neighborhoods, credible information was provided to residents, which helped to locate safe havens, food, and other provisions. Valued and trusted, local broadcasts are “there for their communities for the short and long haul.” (NextTV: 11/30/22)

NEXTGEN TV EXPLAINED

NextGen TV (previously known as ATSC 3.0) makes cutting the cord easier than ever as it offers sports, local news, network TV shows, and more; all “over-the-air”, from an inexpensive antenna. Rolling out across the country, NextGen TV is widely available and “broadcasting in the new standard” which includes “potentially more channels” and image quality that’s “likely better than what you’re used to from streaming or even cable/satellite. (CNET: 12/7/22)